On April 2nd, IGrain India hosted its first-ever virtual conference. The topic was India’s desi chickpea market, and the event was a success, with more than 1,400 registrants. A summary of the views expressed by the panelists is provided below.

Mr. Vivek Jain M/s Bhawna Traders, Beena, Madhya Pradesh

- Madhya Pradesh is the biggest gram producing state in India. Over the past four years, however, the area seeded to gram has been declining.

- In 2017, 3.55 million hectares were seeded to gram. In 2018, that figure fell to 3.43 million hectares, and continued to decline in 2019 to 2.75 million hectares and in 2020 to 2.5 million hectares. The overall quality of gram from Madhya Pradesh is average.

- This season, farmers were more interested in sowing wheat, peas and mustard seeds, as chana prices have been low for the past three years.

- Madhya Pradesh’s production is estimated at 3 million MT in 2021. That compares to 3.8 million MT in 2020 and 4.3 million MT in 2019.

- Yields are down this year because a large part of the crop was affected by frost, disease and rainfall during pod formation.

- Jain believes the market may surge and chana may trade in the Rs. 5600-5900/100 kg range.

Mr. Pukhraj Chopra, M/s Prem Chand Chopra & Company, Bikaner, Rajasthan

- Pukhraj stated that all-India chana production may be below 7 million MT. There is a huge gap between the government’s production estimate of 11.2 million MT and that of traders.

- This season, farmers will drive the market. Farmers do not wish to sell below MSP. If chana prices are Rs. 100-200 below MSP, farmers will prefer to sell stocks to traders rather than the government.

- Most farmers wish to avoid testing and wait for payments.

Mr. Prateek Dhoka, M/s Prateek Jain and Company, Raichur, Karnataka

- Prateek from Karnataka said chana production will be nearly 800,000 MT. Chana prices may be supported by pigeon pea prices. Overall, pulse demand will be good throughout the year.

Mr. Gaurav Bagdai, Wnigs Agro Pvt ltd, Rajkot, Gujrat

- Gaurav Bagdai commented on an interesting scenario of chana crops in Gujrat, Maharashtra and other parts of India.

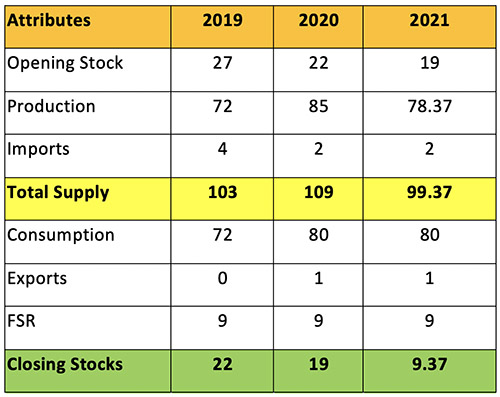

- As per Mr. Bagdai, India’s supply-demand will be as depicted in the chart below.

- As per the table, chana closing stocks will be down by half of what they were last year to 9.37 lakh MT. HoReCa consumption may be down because of COVID, but overall consumption will increase.

- Stockists likely to have completed 60-70% of their targets.

- In the absence of imports of yellow peas and other pulses, chana could see significant movement supported by a scenario of tight production and normal consumption.

- There is good support for prices in the range of 4900/5000 to 6000/6200.

International Chickpea Production

Mr. Jayesh Patel, Group CEO, M/s Bajrang International Group, Dubai shared his views on African pulses

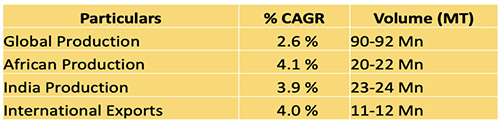

According to Mr. Jayesh Patel, the global production of pulses is as follows:

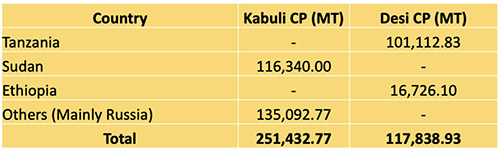

- According to Mr. Patel, Sudan’s Kabuli Chana harvest has begun and production may reach 1.4-1.5 lakh MT; exports may reach 0.8-1 lakh MT.

- Tanzania’s desi chana sowing takes place from June to July. Local consumption may reach 10-15,000 MT and exports may reach 100-120,000 MT.

- Ethiopia is not an exporter of chana. The harvest there is finished. Production is 3 lakh MT and consumption is 2.4-2.5 lakh MT.

Mr. Dhaval Meghpara, M/s Sunraj Besan and Dall Mill, Junagarh shared his views on Canadian and Australian chickpeas.

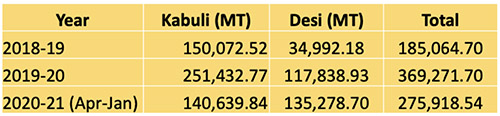

- Dhaval shared the production, export history and outlook for Canadian and Australian desi chickpea crops.

- From the start of the season, Australia’s chickpea exports have moved at an aggressive pace, up more than 46% from last year. The top three buyers are Bangladesh 1.37k MT, Pakistan 37k MT and UAE 7k MT.

- S. chickpea production is down.

- Russian farmers may shift from wheat to pulses due to huge export tax/tariff on wheat.

- On average, Australian chana traded at $630/MT and, with the current tariff, will land at Rs. 8,000/100 kg.

Mr. Hiten Kataria, Sunraj Shipping agency, Mumbai discussed logistics issues

- Kataria discussed the worldwide container shortage.

- COVID-19 has changed the way the world does business.

- It is difficult to re-position empty containers. Shipping lines are reducing vessels.

- Shipping lines missed in between delivery of ports.

- Shipping through the Suez Canal has resumed, but the impact may be felt in the future.

Mr. Arun Soni, M/s Shridhar Industries, Katni, MP discussed problems faced by pulse millers

- Arun Soni shared that after millers purchase Chana at Rs. 4,800/ 100 kg, they sell at Rs. 6,100/100 kg, which includes milling cost of Rs. 75, wastage of Rs. 905, other costs and brokerage of Rs. 135.

- This processed gram is sold by wholesalers at Rs 70 and in malls at Rs. 90-100/kg.

- Millers earn on market fluctuations. Milling margins are low.

- When NAFED sells at low prices, millers lose, but millers get through out supply because NAFED.

Mr. Vivek Agarwal, M/s JLV Agro, Pune shared his view of Pan India production

- According to Vivek, the Pan India production may reach 8 million MT.

- NAFED has distributed nearly 1.2 million MT in PMGKAY I & II which consist mainly of 2019 season crop.

- Overall, there will be good demand throughout the year and the future depends on government policies.

Final comments from IGrain India

- Chana output projected to be 80-85 lakh MT

- Carryout stock much lower than last year

- NAFED procurement may be less; a good sign for the future

- At Rs. 8,500/quintals, imports not feasible under current tariffs

- There are crop issues throughout India, with the exception of one or two states

- Sowing patterns are changing. MP farmers are shifting to other crops

- Throughout the world, it is a challenge to secure empty containers

- Millers have limited margins and see a profit only when there are price fluctuations. Wholesalers and retailers do well.

- Indian traders/importers are losing hope on the government because of changing policies, delays in the issuance of licenses. Last year, large sums of money were surrendered/blocked due to late opening of stocks.

- Import duties should be dynamic.

- The government needs to be more transparent and amend policies to create win-win situations for all stakeholders from farmers to consumers. (A tough task based on intentions.)

- Government may have to consider allowing pea imports or reducing the tariff on chana to balance supply-demand.

- DGFT intends to allocate import quotas via a lottery system. This will be a huge task as import applications will be more than triple what they were last year.

- Last but not least, the market is expected to trade at Rs. 5,100 – 6,500. If import policies are not changed, prices could exceed Rs. 7,000 by December.

- All views expressed are personal.

Abbreviations

Tuar/ Arhar: Pigeon Peas PP

Mung: Green Mung

Urad: Black Matpe

Chana: Gram, Desi Chickpea

Matar: Pea

Masur: Lentil

Mandi: Market yard

Bhav: Prices

Dal/Daal: Processed Pulses (Directly for human consumption)

Rs: Indian Rupees (1$=Rs 72.95)

Rahul Chauhan

Director, IGrain India

igrainind@gmail.com

+91 9350141815

Twitter igrain_india